Finance is Going Digital Faster Than Ever – Can You Keep Up?

From payments and lending to wealth management and insurance, financial services are being reshaped by technology. Customers now expect secure, seamless, and mobile-first experiences as the standard.

But here's the challenge:

- 1 Traditional systems can't deliver the speed or convenience people demand.

- 2 Security and compliance requirements are stricter than ever.

- 3 New digital-first competitors are entering the market every day.

- 4 Falling behind on tech means losing customer trust and revenue.

Without a custom fintech app, it's nearly impossible to compete in a space where innovation sets the winners apart.

Customers Won't Wait - They'll Switch

A clunky app or outdated platform doesn't just frustrate users - it drives them straight to competitors offering faster payments, smoother onboarding, and better security.

And once you lose a customer's trust in finance, it's nearly impossible to win it back.

Meanwhile, digital-first fintech startups are scaling rapidly, fueled by apps that prioritize user experience, compliance, and innovation.

Every day without the right fintech app development strategy widens the gap between your business and the competition.

Imagine Offering Banking-Grade Security with Startup-Level Speed

With NCrypted's Fintech App Development Services, you can:

- 1 Launch secure, compliant apps for payments, lending, wallets, or investments.

- 2 Deliver lightning-fast onboarding with features like eKYC and biometric login.

- 3 Provide customers with real-time transactions, notifications, and analytics.

- 4 Scale confidently with future-ready tech that grows with your business.

It’s not just about keeping up - it's about taking the lead in the digital finance revolution.

Let's Build the Fintech App Your Business Deserves

Stop patching problems with outdated tools. Get a custom-built Financial Technology Application solution that gives you real-time control, reduces costs, and keeps customers coming back. We'll guide you from idea to launch - fast.

Book Free ConsultationStronger Security, Smarter Fintech App, and Faster Growth

Types of Fintech Apps

-

Banking App

Banking is no longer about standing in line at a branch - it's about giving customers control right from their phones. A custom banking app lets you offer seamless account management, instant transfers, balance checks, and even digital onboarding with KYC. The result? A secure, always-on banking experience that builds trust and keeps customers loyal.

-

Payment App

In today's world, speed and simplicity drive adoption. A payment app allows businesses and individuals to send, receive, and split payments instantly - whether through QR codes, wallets, or peer-to-peer transfers. By offering secure, frictionless transactions, you stay competitive in a market that demands convenience at every checkout.

-

Investment App

Investing has gone mobile, and customers expect real-time market access in their pockets. A custom investment app makes it easy to buy, sell, and track stocks, mutual funds, or crypto on the go. Add features like portfolio insights, automated alerts, and AI-powered recommendations, and you turn first-time investors into long-term users.

-

Insurance App

Insurance doesn't have to feel complicated. With a custom insurance app, customers can compare policies, manage claims, and renew coverage in just a few taps. Real-time support and transparent policy details build trust while reducing paperwork for both sides.

-

Lending App

Borrowing money has gone digital. A lending app makes it easy to apply for loans, check eligibility, and track repayments - all without visiting a bank. With features like instant credit scoring and automated approvals, you can serve more customers faster, while keeping compliance in check.

-

Wealth Management

Customers want more than numbers - they want insights. A wealth management app helps users track assets, set financial goals, and receive personalized advice. By combining data-driven analytics with intuitive design, you give clients the tools to grow and manage wealth confidently.

-

Crowdfunding Apps

Funding ideas is now social. A crowdfunding app connects creators, investors, and communities, making it easy to pitch projects, collect funds, and track progress transparently. With the right platform, you empower innovation while building trust among backers.

-

Buy Now Pay Later

Shoppers love flexibility. A BNPL app lets customers split payments into installments while merchants get paid upfront. It's a win-win: users enjoy affordability, and businesses increase conversions and average order values.

Your Fintech App, Built Around Your Business – Not the Other Way Around

At NCrypted, we don't sell cookie-cutter solutions. We work closely with your team to design and develop a custom Financial Technology Application that fits your operations like a glove.

Analysis

We begin by understanding your business goals, user needs, and Finance technical requirements. This stage ensures we have absolute clarity on what to build, eliminating guesswork and setting the right direction for the project.

Planning

With insights from the analysis, we create a roadmap for your Fintech App development, defining scope, timelines, resources, and technology stacks. This structured plan minimizes risks and keeps the project aligned with your business objectives.

Design (UI/UX)

Our designers craft intuitive user interfaces and experiences focused on usability and visual appeal. We prioritize user journeys, accessibility, and brand alignment to ensure the final Financial Services App product is both functional and engaging.

Development

Our engineers translate designs into fully functional Finance mobile application using clean, scalable, and secure code. We follow agile practices to deliver incremental updates, ensuring flexibility and faster time to market.

Quality Assurance (QA)

Every feature is rigorously tested – from functionality and performance to security and user experience. This ensures your software is reliable, bug-free, and ready for real-world use.

Launch & Support

We handle smooth deployment and assist with your go-to-market strategies. Post-launch, our support team ensures stability, updates, and enhancements to keep your Fintech App performing at its best.

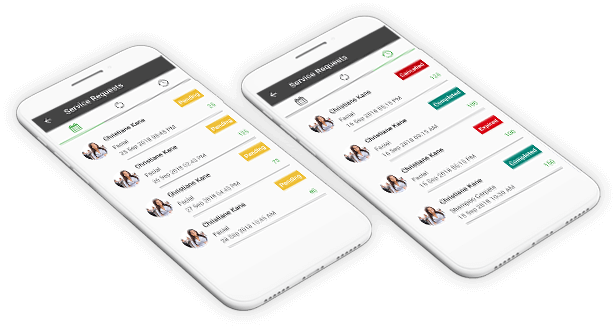

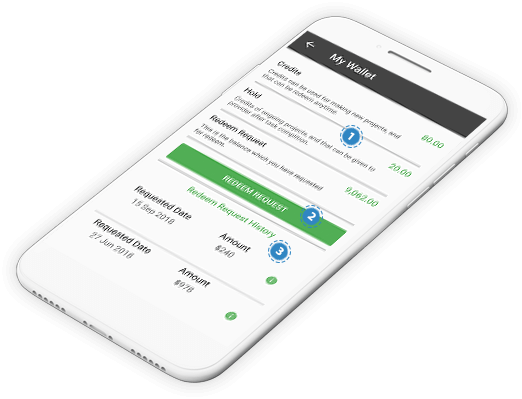

Top Mobile Apps Developed by NCrypted

Why NCrypted for Fintech App?

-

Qualified Team Of Technocrats

-

Custom-Built Solutions, Your IP

-

End-to-End Development

-

1,000+ Successful Clients

-

Robust Security & Compliance

-

AI Support & SEO

-

Global Ecosystem & Network

-

20+ Years of Industry Experience

-

Dedicated 'Human' Support

Over 500 startups trust NCrypted with their Finance business

NCrypted understands our project and shows keen interest in listening to our requirements. I have spoken to the business team at NCrypted more, in recent times, than anybody else regarding my project. I have really high expectations for them now on my upcoming projects.

Jan Rangul - President, Loci360 (Norway)

From the get-go, the business analysts that were working with us started up professionally, spoke English, and communication was flawless; they understood what we needed, addressed our concerns, and started their research & development; after that, everything is as smooth as it should be.

Hares Nayabkhil - President, Greenlight Payments, Inc. (USA)

FAQs - Fintech App Development

The cost depends on features, security layers, compliance needs, and platform choice (iOS, Android, cross-platform, web). We provide tailored estimates after understanding your business goals.

On average, a custom Fintech App can take 3-6 months, depending on complexity. Faster MVPs are possible if you want to launch quickly and scale later.

We develop banking, payments, investment, lending, insurance, wealth management, crowdfunding, and BNPL (Buy Now Pay Later) apps - all tailored to your business model.

We follow global standards like PCI DSS, GDPR, KYC/AML, and use encryption, MFA, fraud detection, and audit-ready processes to keep your app secure and compliant.

Yes. We can integrate with core banking systems, payment gateways, CRMs, ERPs, and third-party APIs so your app works seamlessly with your current ecosystem.

Absolutely. We provide maintenance, updates, scaling, and compliance checks to ensure your app stays reliable, secure, and competitive.

Yes. We work with both fintech startups that need fast go-to-market MVPs and established businesses looking for enterprise-grade Finance solutions.

Your Customers Are Ready for Smarter Finance - Are You?

The future of Finance is already here. Don't let outdated systems or off-the-shelf tools slow you down while competitors race ahead. With NCrypted's custom Fintech App development services, you can launch secure, compliant, and scalable apps that earn trust, delight users, and drive growth.

It's your move - start building the Finance solution your business deserves.

Book My Free Consultation